The missing market: How home retailers can better meet the needs of over 50s consumers (online version)

This online report explores the market for ‘inclusive products’ for the home, particularly those found in kitchens and bathrooms.

About us

Centre for Ageing Better

The UK’s population is undergoing a massive age shift. In less than 20 years, one in four people will be over 65.

The fact that many of us are living longer is a great achievement. But unless radical action is taken by government, business and others in society, millions of us risk missing out on enjoying those extra years.

At the Centre for Ageing Better we want everyone to enjoy later life. We create change in policy and practice informed by evidence and work with partners across England to improve employment, housing, health and communities.

We are a charitable foundation, funded by The National Lottery Community Fund, and part of the government’s What Works Network.

Our aim under our housing priority goal is for more people to enter later life in safe and accessible homes that will support them to live independently for as long as possible by:

- existing homes: improving the condition and accessibility of existing housing

- new homes: increasing the diversity and number

Acknowledgements

Thanks to our advisory panel for their support on this project. These included: Sheila Mackintosh from the University of West England Bristol; Ed Warner, CEO of Motionspot; Emeritus Professor Sheila Peace from The Open University; Dr. Chris McGinley from the Helen Hamlyn School of Design, Royal College of Art; Fiona Jarvis, Founder of Blue Badge Style; Dr. Lynne Corner from VOICE; Elspeth Darby from the Disability Unit in Cabinet Office and Samantha Sen from Revo.

Special thanks also to Ed Warner of Motionspot and Richard Ash from John Lewis who provided retailer perspectives from the early stages of this research.

Executive summary

This report explores the market for ‘inclusive products’ for the home, particularly those found in kitchens and bathrooms, that are designed to be suitable and easy-to-use for everyone, whatever their ability. These products could be anything from vegetable peelers and kettles through to larger fixtures and fittings in the home, such as fridges, walk-in showers and built-in storage.

Good inclusive home products are easy-to-use, aesthetically pleasing and affordable. They are designed for everyone, but their features and ease of use can help people to remain living independently in their own homes as they grow older and if their needs change. They differ from specialist products which are products that have been specially adapted for people with a specific disability.

Our research suggests that inclusive home products are not generally recognised in the mainstream retail market and high street stores. Where they do exist, their benefits are often not made clear as part of marketing strategies or at point of sale. As a result, many participants in our research were largely unaware that inclusive products existed and their default position when looking for home products that might help them and be easier-to-use as their needs change was to purchase them from specialist retailers, who focus on retailing specialist rather than inclusive products.

This report is based on research with consumers involving a small-scale survey, in-home visits, accompanied shopping visits, focus groups and national polling. It indicates that retailers and those involved in the development of home products are currently overlooking a potentially lucrative market for a greater and more diverse range of inclusive home products. Over 50s are responsible for half of all household spend in the UK (ILC UK, 2019) and yet the nationally representative poll (Ipsos MORI on behalf of Centre for Ageing Better, 2020) found that, when thinking about home products, less than half of those 50 and over agreed that retailers of home products (that is, fixtures, fittings, appliances, furniture and smaller objects in your home) understand the needs of people their age (40%) or care about people their age (34%).

Estimates suggest that by mid-2030, half of all UK adults will be over 50 (ONS, 2014). It is likely that demand for inclusive, easy-to-use products, fixtures and fittings for the home will only increase in the next 30 years as more people move into their sixties, seventies and eighties. The overwhelming majority of these people, evidence suggests, will want to remain living independently at home for as long as possible (Lloyd, 2015). Inclusive home products could play a key role in enabling them to do this.

This is even more significant given the ongoing impact of the COVID-19 pandemic, with people spending more time than ever before in their homes, often without the network of support they previously had.

This report explores the gaps and opportunities related to meeting over 50s consumers’ needs for inclusive products. While chiefly aimed at retailers, it also provides recommendations for manufacturers and designers, as well as those responsible for developing and managing homes, such as social housing providers and landlords.

Recommendations for retailers

Our research indicates that there is a gap in the market that is not effectively meeting the needs of the growing and potentially lucrative over 50s consumer group who are expected to spend £550 billion a year by 2040, £221 billion more than projected spending by younger households (ILC UK, 2019).

Our work with consumers suggests that retailers and others involved in the development, design and manufacture of home products need to provide a greater and more diverse range of products that are attractive, affordable and easy for everyone to use, regardless of their ability. Based on our research findings we have identified several potential ways to stimulate the market and enable retailers and others to better meet the diverse needs of the valuable over 50s consumer market:

- Expand your range of inclusive home products, fixtures and fittings, with ease of use, aesthetic appeal and affordability used as key considerations in their design, manufacture and marketing.

- Gather more detailed consumer insights from amongst over 50s consumers to improve the design, marketing and retailing of products to older age groups.

- Consider the diverse needs of over 50s shoppers throughout the customer journey from browsing products in-store or online and reading packaging through to purchase, delivery, setup/installation and returns.

- Help over 50s consumers consider and identify their current and future needs both in-store via staff and through better product labelling and online in product information provided.

- Make inclusive design a selling point of products, using market research to identify appealing language and terminology to describe inclusive features and avoid marketing products as age-specific.

- Bridge gaps between the online and offline customer journey to improve confidence in shopping for inclusive products online.

Recommendations for others

- Manufacturers and product designers need to work more closely with consumers of all ages and abilities and ensure home products are easy-to-use for those with a wide variety of needs without compromising on aesthetics.

- Independent product reviewers, such as online review sites, should include wider criteria such as inclusivity, ease of use, and suitability to help inform product choice.

- Training for professionals involved in home design - such as home improvement agencies, architects, tradespeople and interior designers - should include guidance on how to advise people on what kinds of home products, fixtures and fittings could support them as they age and if their needs change.

- All those involved in planning, building and managing homes - including local authorities, developers, social housing providers and landlords - should design, build and fit homes with products, fixtures and fittings that meet the needs of people of all ages, as standard.

Methodology

The Centre for Ageing Better commissioned Open Inclusion and Trajectory Partnership to conduct research on kitchens and bathrooms with older consumers (aged 50 to 84) from their UK-wide research panel between December 2019 and April 2020.

The research comprised of a literature review, small-scale/illustrative survey (100 participants), in-home visits (11 participants from nine households), accompanied shopping visits (nine participants) and online focus groups (19 participants).

Participants came from a range of household compositions, with a mix of socio-economic status and ethnic backgrounds. They had different experiences of disability and long-term health conditions: some identified as disabled, others had significant accessibility needs but did not identify as disabled. A small number of people who did not report any accessibility needs were also included.

The research explored a spectrum of products, from vegetable peelers and kettles through to larger fixtures and fittings in the home, such as fridges, walk-in showers and built-in storage.

While most of this research was carried out prior to the COVID-19 pandemic, what this research has uncovered about how to meet the needs of this vast and diverse consumer group is now more important than ever as more of us are spending more time in our homes.

Further information about the research methodology and findings can be found in the full research report on our website.

This project was supplemented by a face-to-face poll conducted by Ipsos MORI on behalf of Centre for Ageing Better that surveyed a nationally representative sample of 912 adults aged 50 years or older across Great Britain between 21 February and 12 March 2020.

Since most findings presented in this report are based on research with a relatively small total sample size of 120 adults aged 50 and over, the findings should not be viewed as representative or definitive. Nevertheless, the detailed insights gathered from written, verbal and observed consumer feedback suggest important trends that this report seeks to illuminate.

Preface: Definition of inclusive products

Mainstream and easy-to-use

In this report, the term ‘inclusive products’ refers to the British Standards Institute’s 2005 definition of Inclusive Design as mainstream/non-adapted design in line with the definition set out in the University of Cambridge’s Inclusive Design Toolkit:

The design of mainstream products and/or services that are accessible to, and usable by, as many people as reasonably possible without the need for special adaptation or specialised design.

The images below depict products that have been designed to support people to pour hot water easily. The Breville Hot Cup illustrated below (Figure 1) fits this definition of an inclusive product. It has been marketed as a universal product and can be found in high-street stores such as Argos and Currys. By contrast, the Universal Kettle Tipper (Figure 2) has been marketed as a specialist ‘kitchen aid’ and can be found primarily on specialist retailer websites.

The over 50s consumer market

Over 50s consumers are a valuable and growing market whose needs - our research suggests - are currently not being well met by retailers. The nationally representative poll (Ipsos MORI on behalf of Centre for Ageing Better, 2020) found that, of people aged 50 and over:

- only two in five (40%) agreed that, when thinking about home products (that is, fixtures, fittings, appliances, furniture and smaller objects in your home), retailers of home products understand the needs of people their age

- only a third (34%) agreed that retailers of home products care about people their age

Over 50s consumers have a huge spending power, already spending £319 billion a year (excluding housing costs), equivalent to roughly 54% of total household consumer spending (ILC UK, 2019). Aside from clothing and footwear, they spend more on all categories of goods and services than younger households (ILC UK, 2019).

Despite this, products that are designed to support the needs of over 50s consumers appear to remain an overlooked, and at best niche market for retailers. Too many older consumers still feel that businesses don’t understand their needs or care about their age group, with 35% of adults revealing they began to feel neglected or invisible in society at age 50, partly because they feel that brands don’t advertise to people their age (36%) and there’s no one their age featured in magazines (21%) (SunLife, 2020).

While many of us remain healthy and strong well into older age, we are more likely to experience a decline in our physical strength and mobility and to find home-based day-to-day tasks more difficult as we age.

Almost half of over 65s (45%) personally worry about themselves ‘struggling’ with everyday activities like cooking, bathing or eating in the future (YouGov on behalf of Centre for Ageing Better, 2019). With more than 80% of the homes that will exist in 2050 having been built already (Boardman et al, 2005), access to well-designed products, fixtures and fittings for our homes will support us to live independently, confidently and safely.

Our work with over 50s consumers indicates that developing specialist products and services specifically for the ‘older consumer’ will fundamentally miss the mark in capitalising on this market opportunity. While specialist adaptations such as handrails and stairlifts are commonly used to make homes liveable as people age, improving quality of life, increasing independence and reducing the need for formal care and support, they are often only installed reactively after a crisis event such as a fall (Centre for Ageing Better, 2018).

Key findings

Key consumer insights

Based on our research with over 50s consumers, we have identified six key trends and insights that designers, manufacturers, retailers and other consumer-facing businesses should potentially consider if they want to better meet the needs of this growing consumer group:

- Many over 50s are making changes to their homes, highlighting the potential market opportunity.

- Over 50s consumers want products that are easy-to-use for all ages and abilities.

- Over 50s consumers want better advice from retailers about products. Many don’t think about how their needs will change as they age, and the impact of this on their home environment. They would welcome better advice and guidance from retailers about products that could help them.

- Specialist or age-targeted products can be off-putting, with our qualitative research revealing concerns from participants over the price, aesthetics and stigma surrounding ‘specialist’ products designed specifically with disabilities in mind, such as grab rails and shower seats.

- Inclusive products need to be easier to find. This is the case both in-store and online with a lack of information and experiential challenges such as narrow aisles in-store presenting barriers to purchasing inclusive products. A lack of common terminology contributes to this challenge.

- Some retail staff can lack awareness of inclusive products, which hampers the demand and development of these products.

Many over 50s are making changes to their homes

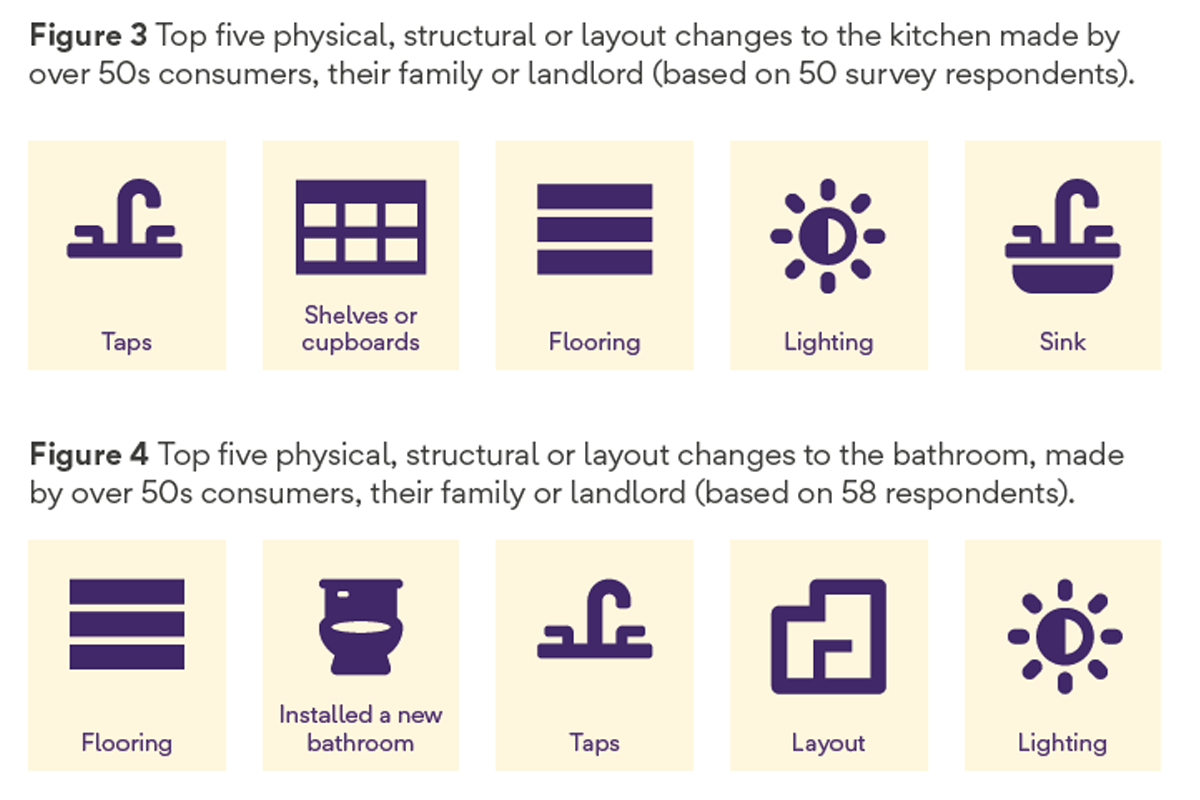

A number of adults aged 50 and over in our research (or people acting on their behalf such as family members or landlords) had made changes to their home and were planning further changes, reinforcing the potential market opportunity of this consumer group. Our small-scale survey of 100 people between the ages of 50 and 84 living across the UK showed that, in their current home, over half of people made significant physical, structural or layout changes to their kitchen (52%) or bathroom (59%), either by themselves or through their family or landlord (Figure 3 and Figure 4), with the majority of changes made in the past five years.

Of those survey participants who had not yet made changes, more than 60% expected to carry out improvements to their kitchen (61%) and bathroom (65%) in the next five years. A number of these changes went beyond aesthetic improvements and were designed to improve safety and independence in the home, with brighter lighting, easier-to-use taps and lighter or easier-to-use cookware among the most popular changes made (Figure 5).

Over 50s consumers want products that are easy-to-use

Over three quarters of respondents from our small-scale survey (76%) that had physical, structural or layout changes made to their current kitchen, had done so to make it easier for them to use, reinforcing the market opportunity for inclusive, easy-to-use products in the home.

Our home visits revealed that when products were no longer able to effectively fulfil an individual’s needs, many adults developed ‘do-it-yourself’ adaptations to make products work better for them, ranging from cost-effective and ingenious solutions, such as elastic bands around shampoo to more easily differentiate it from conditioner for those people with visual impairments, through to more dangerous solutions, such as a blind participant using her own finger to ensure hot water does not overflow in her cup when pouring it from a kettle.

Our home visits identified a small number of products in homes that consumers felt worked particularly well for their needs, from kettles with narrow spouts (Figure 6) - supporting a person with vision impairment to direct the flow of water easily - to voice-assistants (Figure 7) that can enable people to conduct a wide range of tasks hands-free, such as setting a timer or controlling the lighting or heating at home.

Figure 6 Kettle with narrow spout. Figure 7 Voice assistant in kitchen.

However, the limited number of products identified by participants as being inclusive highlights the fact that greater work from retailers, designers and manufacturers to understand the diversity of the consumer market (paying particular attention to over 50s consumers who are more likely to develop accessibility needs) is essential.

In order to better reflect the needs of the growing over 50s consumer base, current practices around market segmentation, which tends to treat all older consumers as a single consumer group, need to be updated. Breaking down age brackets and conducting more targeted feedback and insight with over 50s consumers with diverse needs and abilities will make designing suitable products for this market and successfully retailing them easier.

There is also an opportunity to learn from consumer workarounds to make products work better. In many instances, minor changes to products (such as differentiated microwave buttons to support someone with vision impairment to identify different settings) could have made them significantly more suitable for those with broader needs.

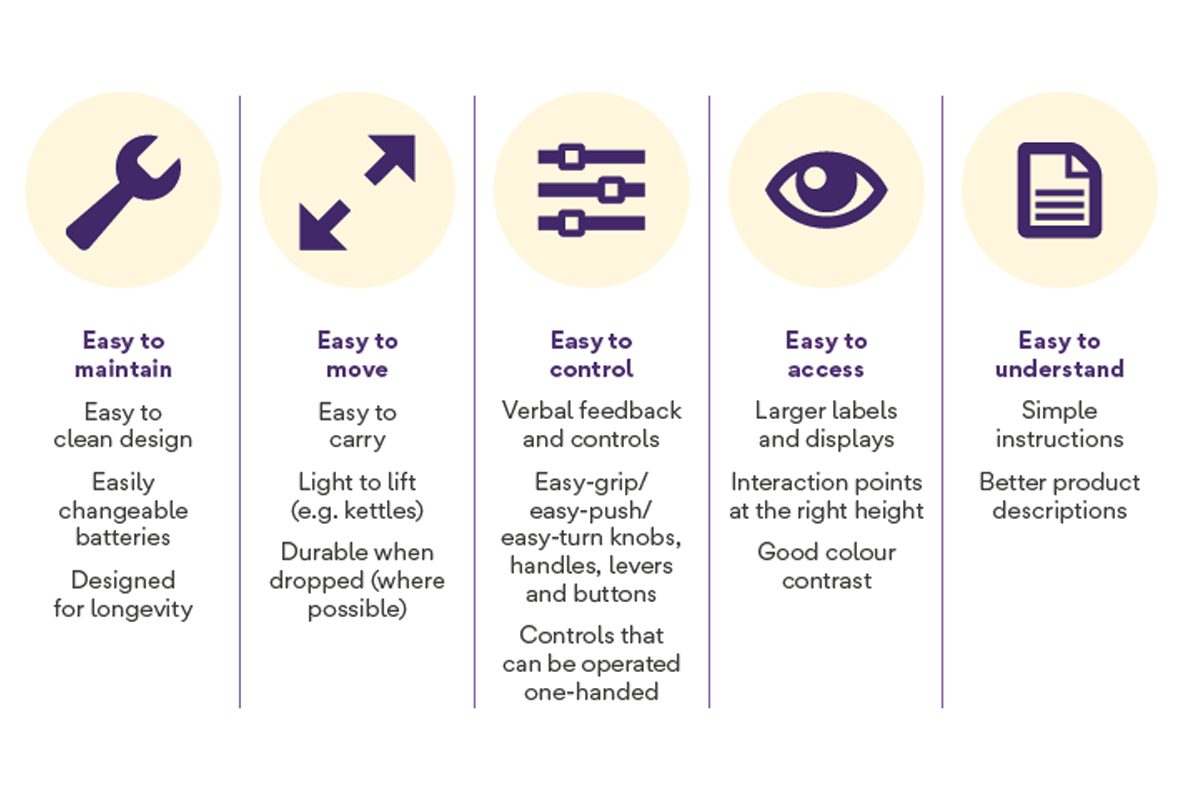

Figure 8 shows some examples of inclusive features consumers articulated they needed (and some we perceived) during our research.

Figure 8 Examples of inclusive features consumers wanted to see considered in the design of home products.

Over 50s consumers want better advice from retailers about products

Our home visits revealed that although participants were making changes to their home to improve ease of use, they were not necessarily doing this with their future needs in mind. For many it remained difficult to recognise barriers in their home that, if removed, would allow them to achieve their goal of living in their home to the end of their life.

I’m going to roll with the punches - you don’t know what will be thrown at you in 20 years.

However, older consumers welcomed the idea of retailers offering them more information and guidance, with 59% of the adults aged 50 or over polled (Ipsos MORI on behalf of Centre for Ageing Better, 2020) agreeing that in the future they would benefit from retailers giving them advice about products that might help them if their needs change as they grow older.

Our work with consumers also found key transitional moments, such as helping parents with increasing needs make changes to their home, having younger family members come to visit or planning major renovations, could also temporarily broaden people’s perspectives, and an opportunity exists for retailers to support individuals to plan for their future needs.

Currently consumers appear to favour specialist over mainstream retailers to provide them with good advice about products that could help them with their changing needs. When asked about to what extent, if at all, they would trust each of nine different items to provide good advice on products that could help them with their changing needs as they get older, 71% of those 50 and over said they would trust specialist retailers a “great deal” or “a fair amount”, in comparison to 49% of those who said they would trust mainstream retailers (Ipsos MORI on behalf of Centre for Ageing Better, 20201). This suggests there is work to be done by mainstream retailers to develop their product ranges and position themselves as trusted and knowledgeable sellers of inclusive products.

We can only afford to do it once - so it needs to be done properly… I don’t trust builders and [named retailers] only fit things for your existing layout. There’s no one you can go to for advice to plan for the long term…

Beyond retailers, our small-scale survey highlights how consumers use a number of routes and touch points to identify which products are right for them, including advice from friends and family, advice from occupational therapists and independent reviewers (Figure 9, Figure 10 and Figure 11).

This reinforces the important role of consumer facing organisations beyond retailers, such as independent reviewers and tradespeople to be aware and - where relevant - trained on the benefits of inclusive products to support consumers to make informed purchasing decisions. Housebuilders and professionals fitting out housing or commercial facilities also need to be aware of the benefits of these products.

Specialist or age-targeted products can be off-putting

Our qualitative research revealed concerns from consumers over the price, aesthetics and stigma surrounding ‘specialist’ products designed specifically with disabilities in mind, such as grab rails and shower seats. This echoed previous Ageing Better research (2018) which suggested the clinical appearance and stigma attached to home adaptations meant people put off making necessary changes to their homes until they reached a point of crisis such as a fall - which meant they didn’t benefit from the pre-emptive support they needed.

There is a gap in the market

The lack of awareness of inclusive home products - products that are affordable, attractive, easy-to-use and part of a retailer’s mainstream offer - also appears to be creating a gap in the market where neither the specialist nor the mainstream retail market is fully serving the needs of older consumers.

There is an opportunity for retailers, manufacturers and designers to address this gap through better design of products to make them more aesthetically pleasing. Thinking about inclusivity and ease of use early on in the design, manufacture and procurement process and proactively marketing inclusive features as ‘better for all’ could also ensure these products are affordable - another concern our consumer research identified.

Our research reinforced the market potential of aspirational and age-inclusive marketing with most research participants not wanting to be treated differently to younger customers and preferring to see terms like ‘for families’ or ‘for all’ on products.

Inclusive products need to be easier to find

Generally, once our research participants wanted to find solutions that worked better for them, they rarely knew how to identify which products were easy-to-use and inclusive, either in store or online.

In the last month, I’ve attempted to find a washing machine with accessibility features [easy to open doors, easy loading and loud enough tones indicating the end of a cycle]. Actively looked for it and couldn’t find it.

Terminology seems to be an issue, with many consumers in our small-scale survey holding contradictory views about what ‘inclusive design’ meant, including “designed for all abilities” versus “designed for disabilities”. Some marketing terms participants responded positively to in our qualitative research included “agefriendly design”, “easy-to-use” and “for everyone”. More specific terms describing how products are easier-to-use, such as “light to hold”, “easy to turn controls” or “easy pour” were also suggested as helpful for individuals to align to their specific needs. Most also wanted products to avoid using the word ‘disabled’ or have connotations to disability. For example, they preferred to emphasise a ‘wet room’ rather than saying they have an ‘accessible shower.’ However, further testing is needed to understand the effectiveness and appeal of these terms.

The customer experience around such products also emerged as an issue during our accompanied shopping visits. When shopping online, there was generally a lack of confidence in choosing the right products and understanding how products would operate in real life due to limited product descriptions and images, as well as poor filtering options. Poor digital accessibility posed a challenge in some cases, with cookie overlays occasionally blocking blind screen reader users from accessing retailer websites as well as images on websites lacking alternative text, making it impossible for screen readers to read out meaningful descriptions to blind and low-vision shoppers. Online returns processes were also considered difficult to understand or execute among some of our research participants. As a result, few over 50s in our qualitative research, as well as our small-scale survey, felt confident in conducting their whole purchasing journey online and in-store experiences played a crucial role for many of them (Figure 10 and Figure 11).

Some products I would have to see if they work for me. Take a washing machine… I need a button to open the door, not a lever. The experience is important.

For participants looking to purchase products in-store, a number of experiential challenges made their purchase difficult, such as narrow aisles and product information on packaging not being clearly marked, with limited product descriptions, small font sizes and poor colour contrast text. Poor product displays, particularly those where products were inaccessible, also interfered with the ability of customers to interact with products and understand their inclusive functionality.

Overall, we identified a need for retailers to improve the end-to-end customer experience both online and in store to make shopping more enjoyable, effective and inclusive for people of all ages and abilities.

Some retail staff can lack awareness of inclusive products

In our research many participants sought the advice of retail staff when product descriptions online or in-store did not provide the right level of information.

While in most most cases shop-floor staff provided high levels of customer service, they often lacked sufficient awareness about the range of potential needs of older customers, how to help customers express those needs, or the knowledge of which products would best address their needs, now and in the future. For example, we witnessed a shop assistant suggest that an elderly customer stand on a chair and use a dishwasher funnel to fill a fridge water dispenser.

Our qualitative research identified that many participants have ‘hidden’ needs that they struggle to recognise or articulate. By assuming inclusive product features are of interest to all consumers, and proactively marketing them through product displays and retail staff, retailers could improve the accessibility, awareness and desirability of these products amongst everyone, including for those whom their features would be particularly beneficial.

I couldn’t tell it was special… and now that you’ve told me about those features, I’m impressed!

Key stages in the customer journey

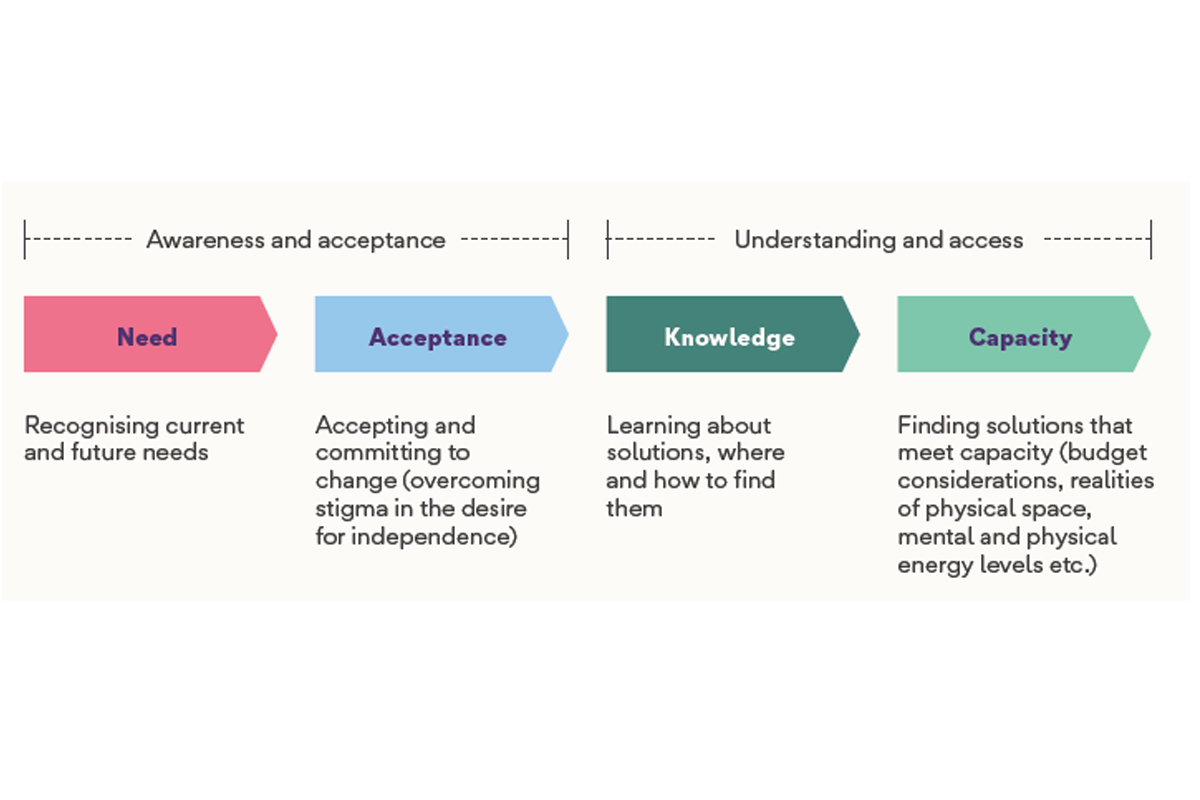

Through our research, we have identified four key stages in the customer journey (Figure 12) that helped to drive changes in the kitchen and bathroom among our research participants.

- acknowledging a personal need

- acceptance that there could be a better way to meet that need

- gathering knowledge about potential solutions

- finding the capacity to buy and install

These four stages are divided into two sub-categories: awareness and acceptance and understanding and access.

Figure 12 Four-stage model for change.

Action by consumers first depends on them recognising current and future needs. Often, they recognise needs only when they are forced to by something going wrong.

Although each stage is dependent on consumers having gone through the previous steps, this is not necessarily a single-direction process. For example, sometimes people recognise a need and accept that they would like to make a change. However, when they look for products that may solve the need, they may be put off by high cost or lack of aesthetic appeal. They may then go through the acceptance stage again and would need to feel there are different or better solutions available to trigger looking again.

Our research suggests that retailers, manufacturers, product designers and a number of key influencers have a part to play to support consumers along this journey.

Conclusion

The spending shift to over 50s has been described as one of the most important trends to hit retailers in the past decade (Carruthers, 2017). And yet our research indicates an unmet need amongst this group.

Inclusive products provide an opportunity to better meet the needs of not only over 50s consumers, but consumers of all ages and abilities. This is potentially a significant business opportunity for product designers, manufacturers and leading retailers which we believe is currently grossly under realised.

Our research has highlighted the importance consumers place on how easy products are to use. While the specialist market for aids and adaptations has gone some way to addressing the functional needs of getting older, we know the aesthetic appeal of products, fixtures and fittings plays a key role in consumer purchasing decisions, and the functional design of the majority of specialist products and their associated stigma with frailty and decline results in consumers delaying making the necessary changes to their home (Centre for Ageing Better, 2018).

Our work with older consumers has highlighted that there is demand for retailers to better address this desire for aesthetically appealing products that are designed with our varied and changing needs in mind. Mainstream retailers that drive this shift in the market by improving the visibility and design of these products could position themselves as a market leader.

The findings from this project are even more significant given the ongoing realities of the COVID-19 pandemic. People are spending more time than ever in their homes, often without the same network of support they had previously and have become more aware of how their home environment, does and doesn’t work for them (Centre for Ageing Better, 2021).

As retailers, manufacturers and products designers look ahead and aim to develop strategies to differentiate themselves in the market in the aftermath of the pandemic, proactively marketing and designing products, fixtures and fittings that work well for consumers regardless of age or ability, as well as the customer experience around such products, provides a huge opportunity for organisations to widen their reach and more effectively meet the needs of consumers of all ages.

References

Boardman B et al (2005) 40% House. Environmental Change Institute, University of Oxford. Available online at: https://www.eci.ox.ac.uk/research/energy/downloads/40house/40house.pdf

Carruthers R (2017) Analysis: Why retailers shouldn’t ignore the silver pound. Retail Week. Available online at: https://www.retail-week.com/data/analysiswhy- retailers-shouldnt-ignore-the-silver-pound/7018946.article?authent=1

Centre for Ageing Better (2018) Homes that help: A personal and professional perspective on home adaptations. Available online at: https://www.ageingbetter. org.uk/publications/homes-that-help

Centre for Ageing Better (2021) No place like home: Findings from the NatCen panel Homes and Communities Study 2020. Available online at: https://www.ageing-better.org.uk/publications/no-place-home-findings-natcen-panelhomes-and-communities-study-2020

ILC UK (2019) Maximising the Longevity Dividend. Available online at: https://ilcuk.org.uk/maximising-the-longevity-dividend/

Ipsos MORI on behalf of Centre for Ageing Better (2020) Ipsos MORI surveyed a nationally representative sample of 912 adults aged 50 years or older across Great Britain. All interviews were conducted face-to-face in respondents’ homes using omnibus CAPI (Computer Assisted Personal Interviewing) between 21 February and 12 March 2020. A quota sample of respondents was interviewed with quotas set by gender, age, working status, tenure and final data were weighted to the known offline population proportions of this audience for age, government office region, working status, social grade within gender, tenure and ethnicity.

Lloyd J and Parry W (2015) Older Owners: research on the lives, aspirations and housing outcomes of older homeowners in the UK. Strategic Society Centre, London. Available online at: https://strategicsociety.org.uk/wp-content/uploads/2015/10/Older-Owners.pdf

Office for National Statistics (2014) ONS (2014) Population Estimates and 2014-based Population Projections. Available online at: https://www.ons.gov.uk/ peoplepopulationandcommunity/populationandmigration/ populationprojections/bulletins/nationalpopulationprojections/2015-10-29

SunLife (2020) Retiring Ageism. Available online at: https://www.sunlife.co.uk/ siteassets/documents/sunlife-ageism-report-2020.pdf

University of Cambridge (n.d.) Inclusive Design Toolkit: What is Inclusive Design? Available from: http://www.inclusivedesigntoolkit.com/whatis/whatis.html

YouGov on behalf of Centre for Ageing Better (2019) Total sample size was 4,488 adults, including 1,110 adults over 65. Fieldwork was undertaken between 25-29 January 2019. The survey was carried out online. The figures have been weighted and are representative of all UK adults (aged 18+).

Image sources

Figure 1: HotCup with adjustable tray, manual stop option (n.d.) Breville: Hot Water Dispensers. Available online at: https://www.breville.co.uk/breakfast/hotwater- dispensers/hotcup-with-adjustable-tray-manual-stop-option/VKT124-01.html

Figure 2: Universal Kettle Tipper (n.d.) Complete Care Shop: Kettle Tippers. Available online at: https://www.completecareshop.co.uk/kitchen-aids/kitchen-aids-and-gadgets/kettle-tippers