The interim report of the Independent Review of State Pension Age published today sets out a clear analysis of the issues relating to the affordability and fairness of potential future increases in state pension age. It is forward looking and takes a broad perspective recognising the issues of fairness within and between generations.

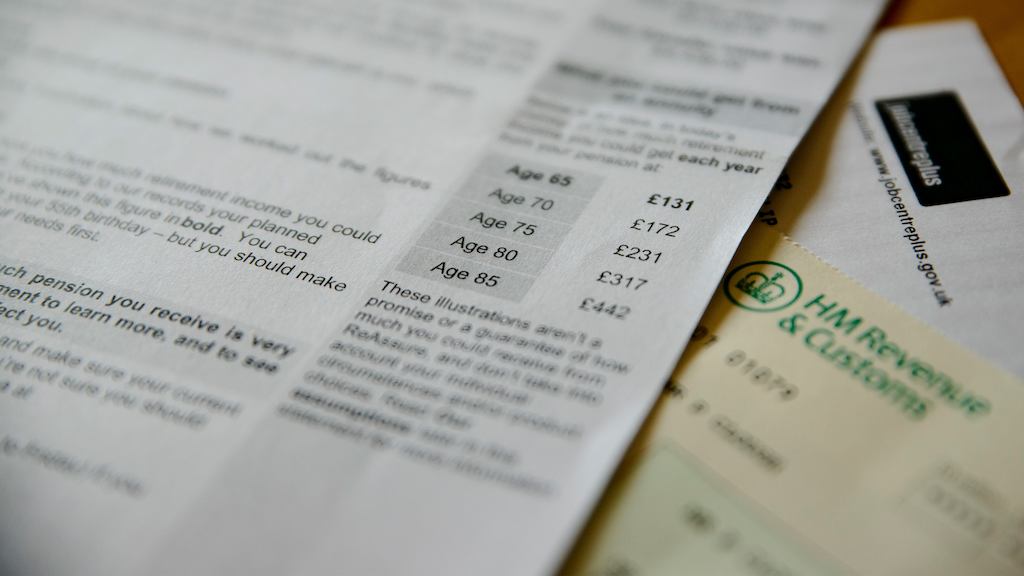

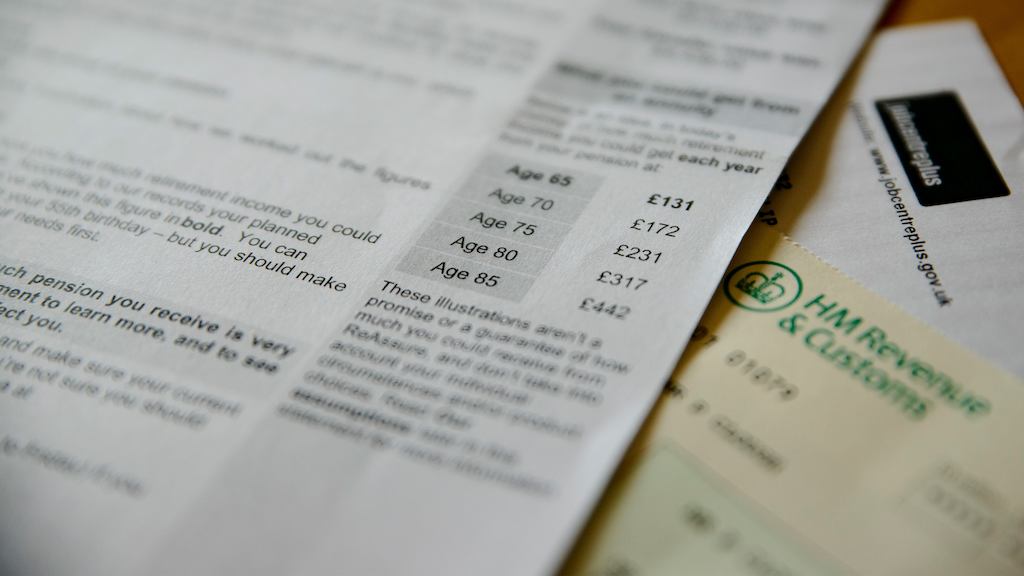

The Centre for Ageing Better’s research shows that financial security is key to a good later life. This means sufficient retirement income will be vital for future generations. The universal state pension will provide a guaranteed minimum income for the majority of people in future but for most people this will need to be supplemented by private income. Future generations will need to save for their later life but will also need to work for longer if they are to enjoy a decent living standard. The report rightly identifies some groups who are more at risk of having insufficient income in later life and who are more likely to rely on the state pension including carers, people with disabilities, the self-employed, ethnic minorities and women.

The interim report highlights many of the issues faced by people’s ability to remain in fulfilling work as they age. As our submission to the review pointed out simply raising state pension age in line with average life expectancy, would not address the huge variation in life expectancy and healthy life expectancy across income, geography, socio-economic situation and other demographic factors.

Action will need to be taken to support those who find it difficult to continue to work until state pension age currently, many of whom would be adversely affected by any increase in state pension age. We welcome the government’s recent announcement of a new Business Champion for Older Workers. A coordinated response from government and employers is needed to bring about the necessary changes.