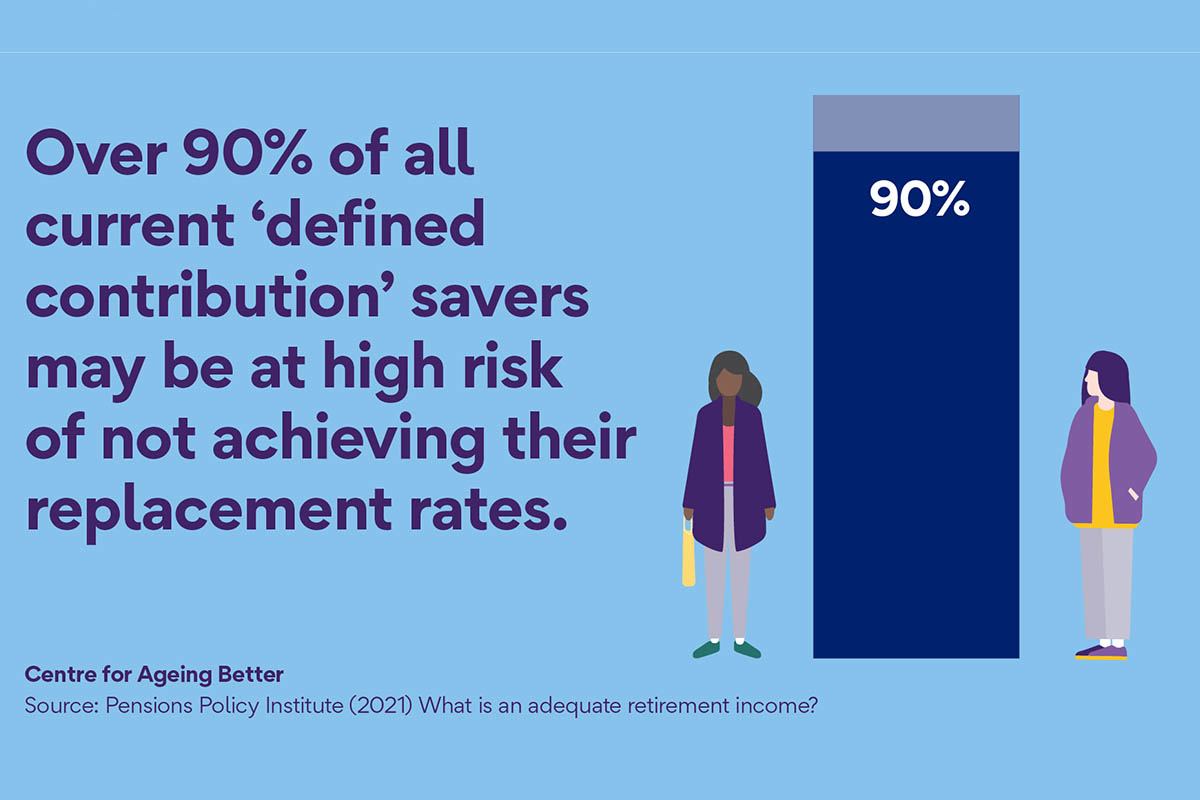

“The low level of the state pension in the UK, at just 24% of the national average income, means people are unable to rely on the state pension to provide an adequate income in retirement. Many people don’t have enough pension savings to support a decent standard of living in retirement.

“Further action is needed to ensure millions of people approaching retirement and generations to follow do not find themselves without adequate income in later life.

“While auto-enrolment is boosting the number of people saving for retirement, it is not sufficient to secure financial security in later life. We are calling on government and employers to do more to support people to achieve a decent standard of living in retirement and to boost pension savings for those approaching retirement.”